It is said the markets always come back from stock crashes, and indeed tracking the Dow from its inception, it has.

That said, why do investors wring their hands and lose sleep whenever the market suffers a severe setback?

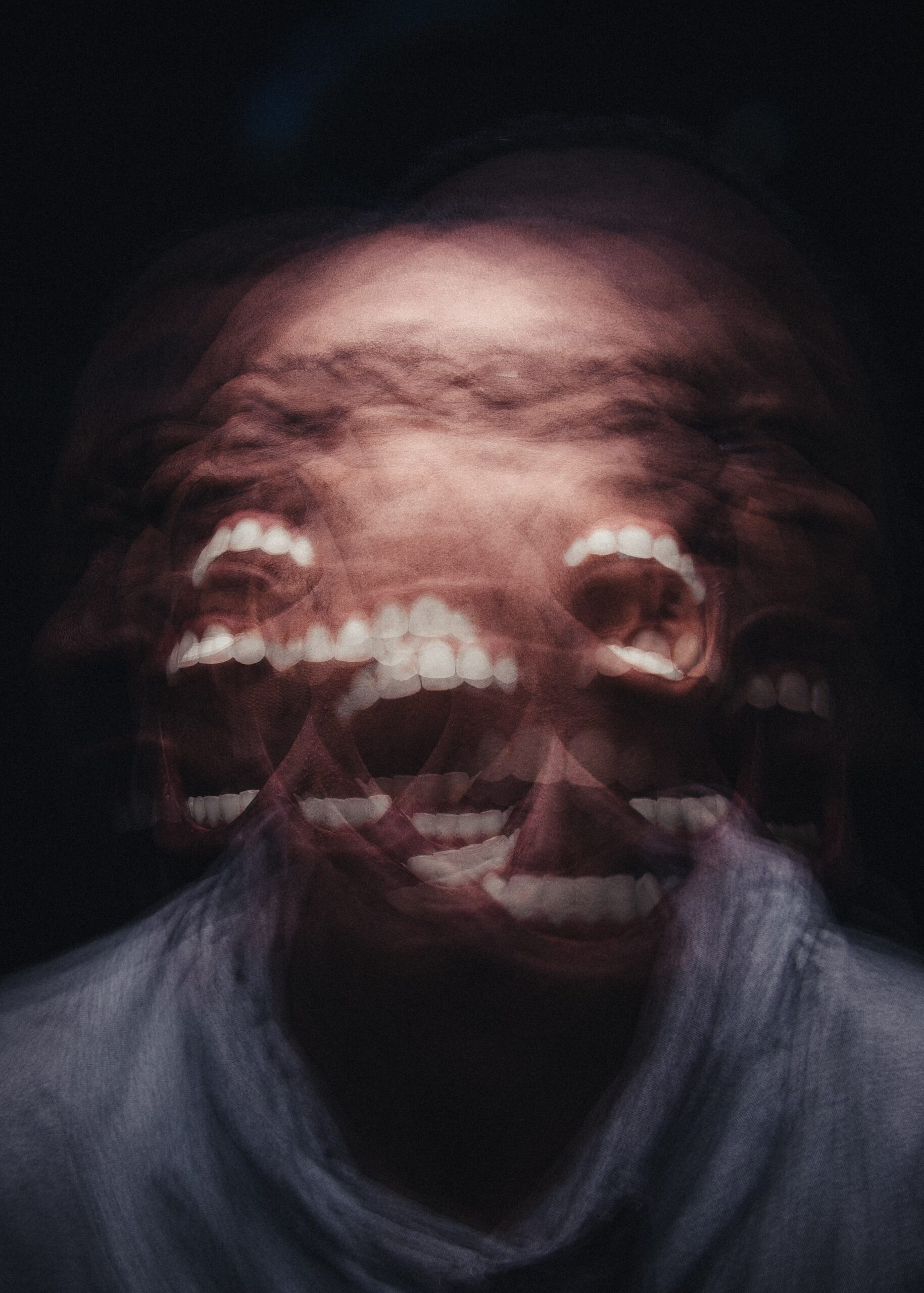

It’s human nature to abhor losing money. Especially if it is your life savings. Moreover, even if we are fully aware of the market’s perfect track record of returning to an upward trajectory, the demons of the mind never fail to play havoc with our psyche and conjure up thoughts of losing it all in a horrendous market wipeout.

If you have experienced these feelings during market crashes, you are not alone. Almost everyone I know, both professionals and novice investors alike, have fallen victim to the “what ifs” of an Armageddon-like moment in the markets. Investors then oscillate between sitting tight or selling out.

Few if any will actually buy more stock once the freight train of a major crash gets rolling.

It takes a bulletproof mindset to stay calm as thousands of dollars disappear down the rat hole of a Wall Street crash.

Most investors will call their advisor and want him or her to give them at least some semblance of a warm and fuzzy feeling that all is ok. The buy and hold mantra anchors the argument and indeed, during the many crashes I have seen, most will try and grin and bear out a market crash. Better yet, maybe “grit and bear it” is a more suitable term.

In any case, the question becomes: can the market ever crash, defy historical precedent, and fail to come back in a once in a lifetime final or prolonged wipeout?

For that type of market crash to occur, it would have to be a prolonged and wealth obliterating event, somewhere in the order of an 80% retracement of the markets, much like we saw in 1929. That event witnessed a 73% retracement between 1929 and 1932 and didn’t recover for 25 years, not counting for inflation. Ouch.

What could cause such a crash?

In my opinion, it’s unlikely the excessive speculation we saw in the 1920s would cause a similar event now. That sort of speculation already exists on certain levels in today’s markets. More likely, it would be an economic catastrophe along the lines of a Mexican Peso moment. In other words, a currency crisis brought on by monetary inflation (money printing and massive deficit spending).

Should investors do anything to prepare for such an event?

It’s likely the majority of investors and advisors think the possibility of such an occurrence is so remote, no preparation is necessary. I would counter this argument by notating the most important consideration by professional traders and money managers alike is loss prevention and control. Iconic investor Warren Buffett says the two most important rules of investing are:

- Don’t lose money

- Don’t forget rule one

I don’t know a professional trader nor money manager worth their salt that does not use loss prevention techniques in an attempt to limit losses when and if they occur. If the pros use loss prevention techniques, why don’t mom and pop investors and their advisors use them as well?

Good question.

A crash of the magnitude of which I am talking about could obliterate one’s life savings for good or at least for an extended period of time. With that in mind, do not consider some sort of loss prevention in the face of what kind of damage could be inflicted on retirement savings is, in my opinion, foolhardy. The possibility of the event may be remote, but if it occurs, you would have wished you had some sort of loss prevention strategy in the worst way.

This article is opinion only of Marc Cuniberti, and may not represent those of this news media and should not be construed as investment advice nor represents the opinion of any bank, investment or advisory firm. Neither Money Management Radio (“Money Matters”) nor Bay Area Process receive, control, access or monitor client funds, accounts, or portfolios. Contact: (530)559-1214 or news@moneymanagementradio

Photo by Nsey Benajah on Unsplash