Covid-19 certainly has lived up to expectations, at least on the effect it has had on global stock markets, world governments and the entire population of the earth for that matter.

A global shutdown of businesses, a halt to human travel and even personal interaction, more government stimulus than has ever been used before, and economic damage that has yet to be realized but expected to be historic.

The news is materializing fast and furious and certainly news medias and analysts are burning the midnight candle to the nub trying to keep up with it all, this analyst included.

Speaking of keeping up, the government is initiating round two of the Paycheck Protection Plan (PPP). The first round of several hundred billion was eaten up by applicants within days. Likely the fund running out of money was a surprise to many. How fast it went was another eye opening event, one of the many surprises that the Corona event has brought upon us. Protests were immediate and pronounced that more was needed and quickly.

The Feds have allocated 454 billion to re-inflate financial assets. That amount will be leveraged up to 4.5 trillion through financial mechanisms to complicated to explain here. Just think of it as similar the TARP program of 2008 fame (Troubled Asset Relief Program).

Some will call it what the “Five Minute Forecast” newsletter calls it, a corporate welfare slush fund, while others will label these programs as absolutely necessary to keep our economy from imploding from within (again).

Billions more are being sprayed everywhere by more than a dozen programs Federal programs designed to liquefy the system. The word “spray” pretty much gives an accurate visual to the reader.

China Gross Domestic Product (GDP) has shrunk for the first time since 1992. No surprise there and likely many nations GDP will follow suit.

Jobless claims rose north of 22 million here in the U.S. and while the velocity of filings actually fell last week compared to the initial rush of applicants since the shutdowns, the numbers of those filing is staggering. The total number when all is said and done will border on unbelievable if current rates continue.

The shutdown harbors immense costs to businesses both small and large. Mom and pop stores everywhere are bleeding red and it is estimated 25% of small business will not survive (CNBC). Other almost insurmountable problems specific to particular industries run the gamut from having to park thousands of complex airliners which require vast amounts of daily maintenance as they sit idle to food stuffs having to be destroyed as restaurants sit idle test imaginations as to how bad this really is and how can some businesses possibly cope. Many will not be able to.

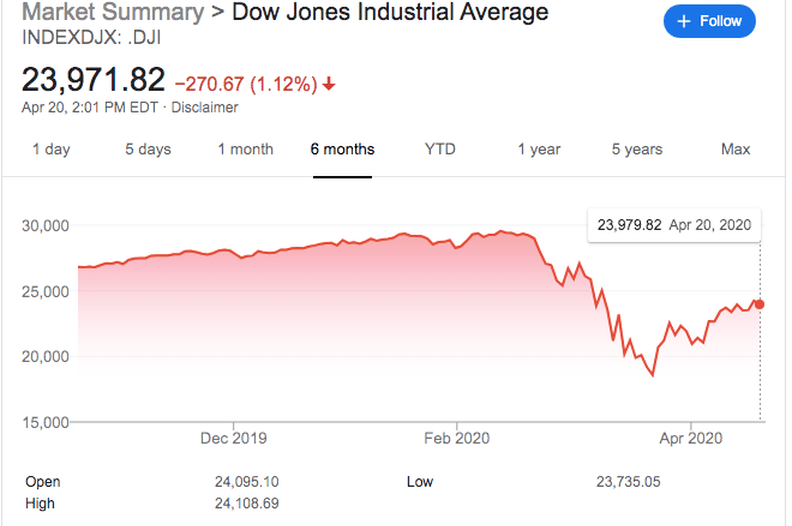

Meanwhile to the anger of many, the stock market is up some 25% off its March lows, the exact number is sure to change by the time you read this. A now classist shot of CNBC anchor Jim Cramer, host of Mad Money, shows the background shot of a headline stating “Dow has best week since 1938” while the foreground banner states “16 million Americans have lost jobs in the past three weeks”

It’s hard to argue with the outcry arising from the now infamous clip and many CEO’s and VP’s of large corporations have since been asked about it publicly. Most ,if not all, agree with the irony of the happenstance of the photo capture. Some Wall Street analysts have taken the tact that stock markets always look ahead while unemployment figures are backwards looking. Nonetheless its indeed disturbing no matter what the reasoning.

In conclusion, who knows what will transpire in the days and weeks to come. Protests are arising nationwide to end the shutdown as businesses continue to hemorrhage losses due to inactivity. The pressure is mounting on Washington to put even more pressure on the states to lift stay-at home-orders while others call for continued vigilance due to the ongoing threat of contagion and a possible second wave if we get too complacent too quickly.

The economic environment will be forever altered due to the Corona event. There is little doubt so will the world at large be changed forever.

This article expresses the opinions of Marc Cuniberti and should not be construed as individual investment advice. No one can predict market movements. Investing involves risk. You can lose money. Mr. Cuniberti is an investment advisor representative through Cambridge Investor Research Advisors Inc. a registered investment advisor. California insurance license 0L34249