The latest inflation figures recently released confirm what most of us already know. Inflation is bad and getting worse. In fact, it’s the worst in 40 years.

There are many factors causing it.

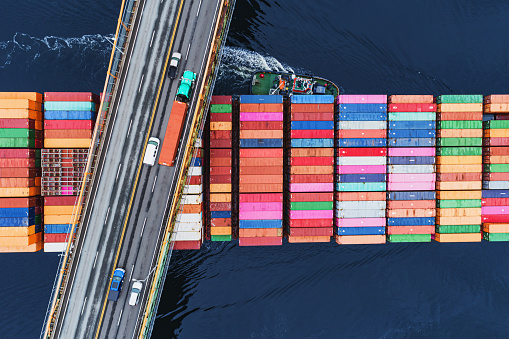

Supply-side shortages range from the lack of available workers to staff manufacturing and shipping facilities, soaring energy prices making shipping costs escalate, skyrocketing commodity prices driving input costs higher, the Russian crisis which is taking another commodity offline, and trade restrictions on still other materials coming out of the eastern block area.

Most egregiously is the monetary driven inflation, which is a rise in prices due to government spending to fund the various CoVid relief programs in the last two years. Those programs range from massive unemployment payments to the CARE programs, the Paycheck Protection Programs as well as infrastructure spending, and other various bailout and assistance programs.

Seemingly, deficit spending considerations, once a main talking point of the GOP, is seldom discussed anymore in the ivory halls of Washington. To even mention a pullback in relief spending means the trap door to any politician that brings it up.

Although Washington acknowledges, and correctly so, the many current causes of inflation, it misses entirely the monetary cause, which is likely causing a majority of the price increases the American consumer and indeed global consumers are witnessing. Simply put, after printing up over five trillion dollars in spending in the last three years or so, the amount is so off the charts, it’s a wonder inflation is not in the double digits already, although it is fast approaching that.

To put a bullet point on the entire blindness of Washington when it comes to monetary caused inflation, more spending programs are being bantered about by both parties.

With the standard of living indexes plummeting the fastest in decades as price increases leapfrog past wage increases, Washington is now talking payments to consumers to help pay for higher gas prices, with the option of repeating such payments should higher gas prices go higher still or persist for longer than deemed tolerable. Amounts discussed range from $300 to $1,100.00 per household, with little more detail given at this juncture.

No doubt, payments to deal with higher food costs and what have you will soon follow.

Not to be outdone, our neighbor to the north, Canada, seems just as oblivious to printing press inflation as we are and announced yet another stimulus check (five hundred this time) will soon be in the mail to everyone making $100,000.00 or less.

No doubt with mid-term elections fast approaching, elected officials everywhere will lean into the public checkbook to shower would-be voters with cash in return for their support at the ballot box.

All this free money sounds enticing, but the question becomes if much of the inflation is caused by government spending on a plethora of past programs, will more programs help the situation or make it worse?

The proverbial observational paraphrase comes to mind where one asks “is the cure worse than the disease?”

Or in this case, is the cure the cause of the disease, or even the disease itself?

Concluding, many an analyst fear that because of the copious amounts of cash now being rained down upon the global inhabitants of the world by world governments, a monetary catastrophe is in the making. It will materialize in the form of, you guessed it, even worse inflation.

No doubt, when that occurs, the Washington’s of the world will still fail to see the cause and put the pedal to the metal once again on their monetary printing presses, and round and round we will go, until the paper, the money is printed on, will be worth more than the number stamped on the bill.

This article is not a recommendation to buy or sell any security or investment and expresses the opinion only of Marc Cuniberti, and may not represent those of this news media and should not be construed as investment advice nor represents the opinion of any bank, investment or advisory firm. Neither Money Management Radio (“Money Matters”) nor Bay Area Process receive, control, access or monitor client funds, accounts, or portfolios. Contact: (530)559-1214 or [email protected]. Marc was recently voted in the “Best of Nevada County” – Best Financial Advisor of 2021 by popular vote.