Looking at the three or six month Treasury bill (T-Bill), there is a lot to like.

Treasury bills, for those wondering, are just IOUs from the government. No need to be complicated here, so just know when you “buy” a T-bill, you have lent your money to Uncle Sam. A three month bill means you can get your money back in three months, and a six month bill means you get your money back in six. So on and so forth ad infinitum up until about 30 year terms which can be called bonds instead of bills. Your payoff is the interest they pay you.

Yes, I know the name change from bills to bonds is confusing, but in my opinion, the financial folks (which I am a reluctant part of) like to do things like that to confuse you to make you think you need us. My opinion of course. Just know however that bills and bonds are both U.S. government debt and the term of the investment is called the “maturity” date. An added bonus is the interest income is also exempt from state and local taxes.

In any case, unlike T bills of the past decade or so which paid a paltry return, these three and six month issues (and even a bit further out) can now pay north of 5% APR thanks to the Federal Reserve’s crusade of jacking up interest rates in an attempt to quell inflation.

Keep in mind APR means “Annual percentage rate”, so you would have to buy a three month T-bill four times in a row to get the stated APR rate. That’s assuming the rates don’t drop, which they could.

One reason to buy U.S. government issues like T-bills is that they are backed by the full faith and credit of the U.S. government. That means they are regarded as having a 100% guarantee as to the terms of the investment.

This is not to say one cannot lose money on a T-Bill. Sell a three month T-bill before the three month maturity date or a six month bill before their six month maturity date, and you could take a hit on the principal. Hence the reason I said “as to the terms of the investment”.

Not rocket science right?

During a recent seminar I gave, everyone in attendance agreed the current rates on short term U.S. debt like T-bills were decent. Then I asked what was bad about a three or six month T-bill paying north of 5%. The room fell silent.

The answer as to what might be not so good is that a three month or six month T-bill are ONLY three or six months. This means that while the current rates may be attractive, rates can move. They can move up or down. And with the Federal Reserve on an historic interest rate crusade, the full effect of their actions are really anyone’s guess. Federal Reserve actions can take many months to a year or more to take hold, so it’s difficult to forecast whether rates will be up or down a year or two from now. Hence the potential drawback of investing in short term T-Bills and the like. If rates move up, short term T-Bills can be rolled over quickly to the new higher rates. But if rates drop, your high paying short term T-Bill goes away when they expire along with your 5% APR.

The key is where we think rates will go in the future? Up or down?

Up, as mentioned above, are good for short term investments as they can be rolled over quickly to the higher rate as they reach maturity. Rates move down and that is bad for short term investments as you lose the rate and the new issues could offer less.

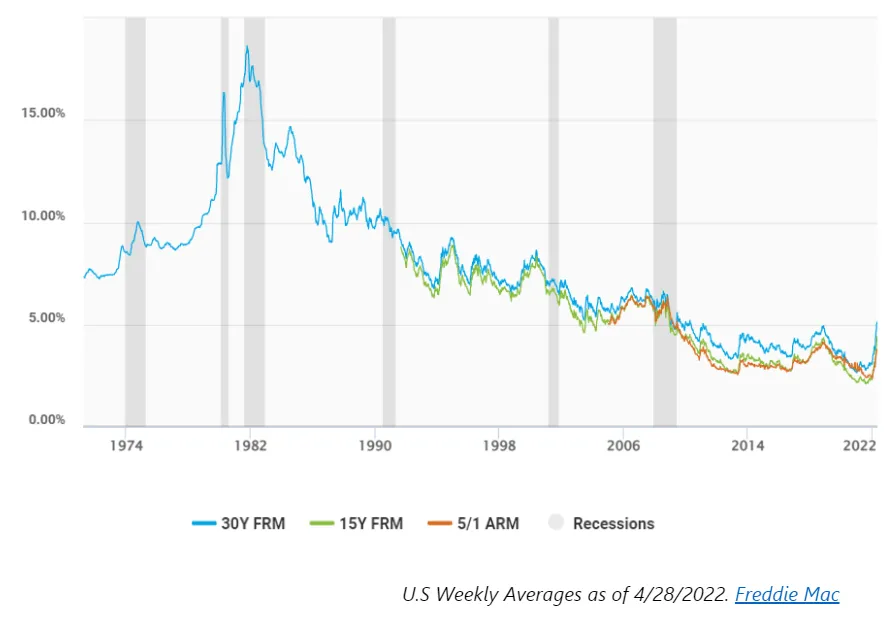

Looking at rates in the past five decades shows a steady decline since the 1980’s. (UNION- Photo also in attachment)

With the exception of the last year, the chart may give us a heads up as to rates and their long term direction. If the long term direction continues, which for all intents and purposes, appears to be down, investors might look for a way to lock in today’s current rates with a variety of investment vehicles that strive to do just that, lock in today’s rates for a longer period of time.

More information and past articles available below.

“Watching the markets so you don’t have to”

This article expresses the opinion of Marc Cuniberti and is not meant as investment advice, or a recommendation to buy or sell any securities, nor represents the opinion of any bank, investment firm or RIA, nor this media outlet, its staff, members or underwriters. Mr. Cuniberti holds a B.A. in Economics with honors, 1979, and California Insurance License #0L34249 His insurance agency is BAP INC. insurance services. Email: [email protected]